Banks, non-bank financial intermediaries and finance companies. Proprietors, lesses or operators of cockpits, cabarets, night or day clubs, boxing exhibitions, professional basketball games, jai-alai and racetracks. Government of the Philippines - for messages transmitted by the Government of the Republic of the Philippines or any of its political subdivisions and instrumentalities;. Agents of foreign insurance companies. Filing Date The return shall be filed and the tax paid within twenty five 25 days after the end of each taxable quarter. For shares of stocks sold or exchanged through primary Public Offering, within thirty 30 days from date of listing of shares of stock in the LSE; and. Operators of international air and shipping carriers doing business in the Philippines.

| Uploader: | Mezijin |

| Date Added: | 7 July 2010 |

| File Size: | 56.66 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 91617 |

| Price: | Free* [*Free Regsitration Required] |

A corporate issuer, engaged in the sale, exchange or other disposition through Initial Public Offering IPO of shares of stock in closely-held corporations at the rates provided hereunder based on the gross selling price or gross value in money of the shares of stock sold, bartered, exchanged or otherwise disposed in accordance with the proportion of shares of stock sold, bartered, exchanged or otherwise disposed to the total outstanding shares of stock after the listing in the local stock exchange: Diplomatic Services - for messages transmitted by any embassy and consular offices of a foreign government.

Proprietors, lesses or operators of cockpits, cabarets, night or day clubs, boxing exhibitions, professional basketball games, jai-alai and racetracks. For shares of stocks sold or exchanged through primary Public Offering, within thirty 30 days from date of listing of shares of stock in the LSE; and.

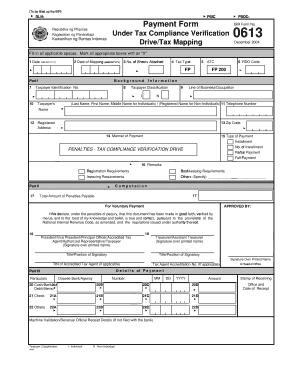

Filing Date On or before the due date for payments of tax as stated in the Special Law. Operators of international air and shipping carriers doing business in the Philippines.

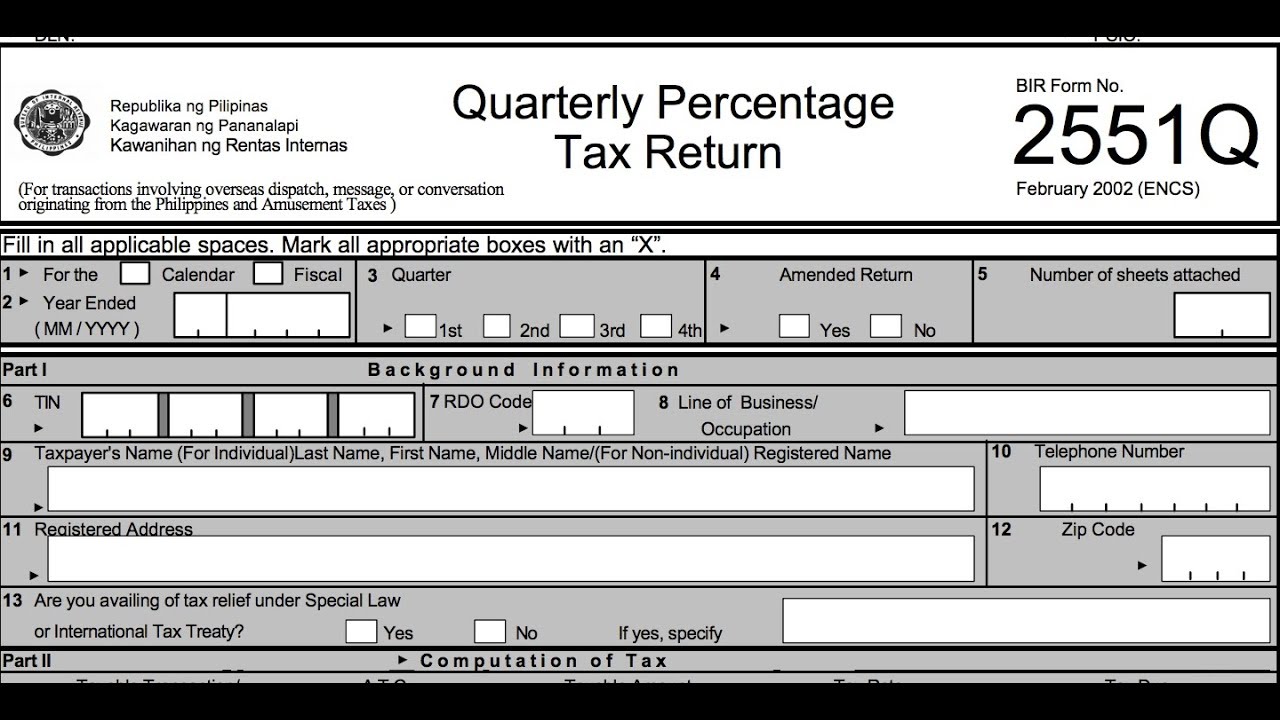

VAT/Percentage Tax Returns

All content is public domain unless otherwise stated. News services - for messages from any newspaper, press association, radio or television newspaper, broadcasting agency, or newsticker service to any other newspaper, press association, radio or television newspaper broadcasting agencu or newsticker services or to bonadife correspondents, which messages deal exclusively with the collection of news items for, or the dissemination of news items through, public press, radio or television broadcasting or a newsticker service furnishing a general news service similar to that of 251m public press.

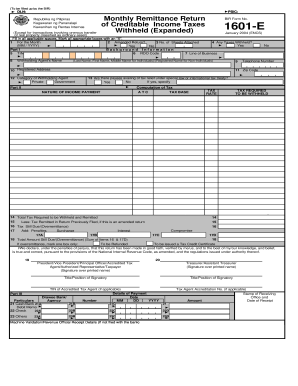

Twenty one 21 days following end of the month. For tax on shares of stock sold or exchanged through secondary public offering, within five 5 banking days from date of collection.

2551k Quarterly Percentage Tax Return Description This return shall be filed in bur by the following: Agents of foreign insurance companies. For tax on sale of shares of stock listed and traded through the Local Stock Exchange LSEwithin five 5 banking days from date of collection.

International organizations - for messages transmitted by a public international organization or any of its agencies based in the Philippines enjoying privileges and immunities pursuant to an international agreement; and.

International organizations - for messages transmitted by a public international organization or any of its agencies based 251m the Philippines enjoying privileges and immunities pursuant to an international agreement; and d. The return shall be filed and the tax paid within twenty five 25 2551m after the end of each taxable quarter.

Banks, non-bank financial intermediaries and finance companies. This return is filed not later than the 25th day following the close of each taxable quarter.

Filing Date The return shall be filed and the tax paid within twenty five 25 days after the end of each taxable quarter. Calendar quarter of Fiscal Quarter.

Filing Date This return is filed not later than the 25th day following the close of each taxable quarter.

BIR Form No. M Monthly Percentage Tax Return - Forms Philippines

exfel Government of the Philippines - for messages transmitted by the Government of the Republic of the Philippines or any of its political subdivisions and instrumentalities; b. A stock broker who effected a sale, exchange or other disposiiton through secondary public offering of shares of stock in closely held corporations at the rates provided hereunder based on the gross selling price or gross value in money of the shares of stock sold, bartered, flrm or otherwise disposed in accordance with the proportion of shares of stock sold, bartered, exchanged or otherwise disposed to the total outstanding shares of stock after the listing in the local stock exchange:.

In accordance with the schedule set forth in RR No. A corporate issuer, engaged in the sale, exchange or other disposition through Initial Public Offering IPO of shares of stock in closely-held corporations at the rates provided hereunder based on the gross selling price or gross value in money of the shares of stock sold, bartered, exchanged or otherwise disposed in accordance with the proportion of shares of stock sold, bartered, exchanged or otherwise disposed to the total outstanding shares of stock after the listing in the local stock exchange:.

The term "taxable quarter" shall mean the quarter that is synchronized to the income tax quarter of the taxpayer i. Franchise grantees of gas or water utilities.

BIR Form No. 2551M Monthly Percentage Tax Return

Franchise grantees sending overseas dispatch, messages or conversations from the Philippines, except on services involving the following:.

Domestic carriers and keepers of garages, except owners of bancas and owners of animal-drawn two wheeled vehicle.

Franchise grantees sending overseas dispatch, messages or conversations from the Philippines, except on services involving the following: Government of the Philippines - for messages transmitted by the Government of the Republic of the Philippines or any of its political subdivisions and instrumentalities. Diplomatic Services - for messages transmitted by any embassy and consular offices of 251m foreign government; c.

Legislative Senate of the Philippines House of Representatives.

No comments:

Post a Comment